Samsung and LG step up OLED TV battle in premium market

Samsung Electronics and LG Electronics, the leading producers of televisions globally based on revenue, are stepping up their competition within the organic light-emitting diode (OLED) TV sector. Despite liquid crystal display (LCD) TVs continuing to hold a substantial portion of the international market, Chinese enterprises have been increasing their footprint with cost-effective LCD options. Consequently, South Korean corporations are redirecting their attention towards high-end television sets, where OLED technology stands as the key battleground.

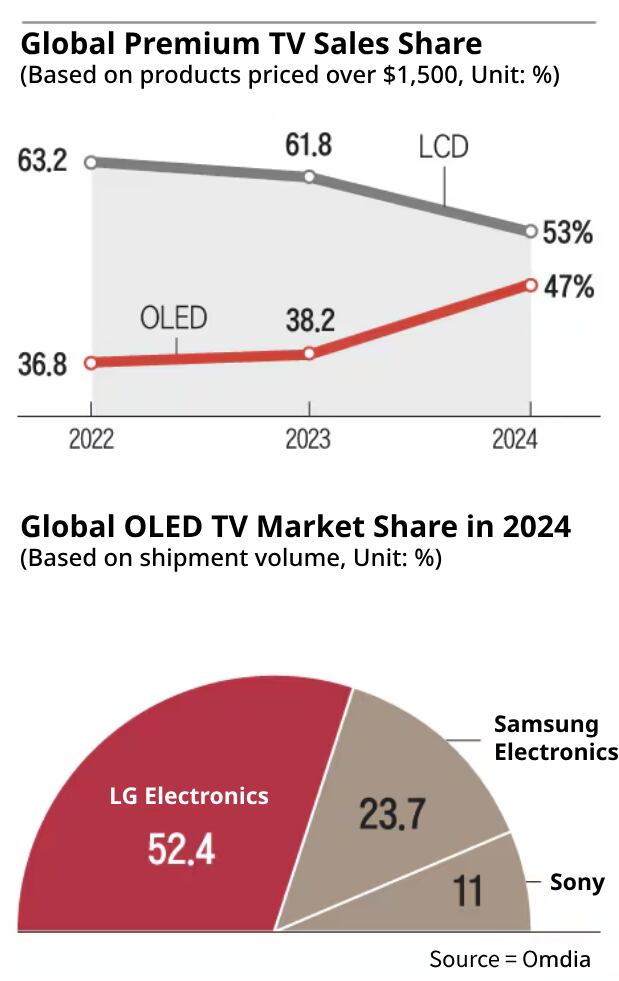

OLED is continuing to grow in popularity within the upscale television segment. Data from market analysis company Omdia shows that OLED TVs made up 47% of worldwide premium TV sales—which includes sets costing more than $1,500—in 2024, an increase from their share of 36.8% back in 2022.

LG Electronics has been a leader in the OLED sector for years, however, Samsung Electronics has intensified its endeavors with an expanded lineup of products. These firms are currently vying fiercely within a marketplace projected by Omdia to be worth 16.8 billion won ($11.37 million) by 2025. This rivalry may have substantial implications for both brands' standings in the high-end television arena.

During a recent product unveiling, Lim Seong-taek, who serves as the executive vice president at Samsung Electronics, stated that the firm intends to secure first place in South Korea’s OLED TV sector. Although Samsung leads globally in total television sales, it lags behind LG when it comes to OLEDs. According to shipping data, Samsung commands only 23.7 percent of the worldwide OLED TV market versus LG’s dominant position with 52.4 percent. In an effort to narrow this disparity, Samsung has outlined plans for expanding its OLED range from ten to fourteen variants within the current year. Additionally, the corporation is enhancing its products through advanced technology integration—specifically artificial intelligence algorithms designed to improve lower resolution imagery and minimize glare on screens. Furthermore, future iterations of Samsung’s OLED televisions will incorporate AI-driven features like live subtitles translation and personalized viewing analytics underpinning their comprehensive approach toward increasing competitive edge in the marketplace.

Ever since launching the industry’s first commercially available OLED TV in 2013, LG Electronics has held onto its top position within this market sector. Recently, the firm debuted new OLED models across eight European markets such as the UK, Germany, and Switzerland. So far, LG has rolled out its 2025 OLED series in about 20 nations with intentions to extend availability to 150 countries.

LG has enhanced screen luminosity in their newest "LG OLED Evo" series through an innovative stacking design for the organic materials used. These new models can achieve brightness levels up to triple those of standard OLED televisions. Additionally, LG is solidifying its market dominance with technologies like wireless HD video streaming and personalized AI-powered interfaces, establishing OLED technology at the heart of their top-tier offerings.

OLED is steadily cementing its position within the luxury television market. In LG's upscale product range, OLED models currently make up 74.9%. Similarly, Samsung has experienced significant expansion, with the proportion of OLED models in their premium series increasing from 7.1% in 2022 to 31.8% in 2024.

The escalating rivalry between Samsung and LG in the OLED sector is fueled by the rising clout of Chinese producers. Companies like TCL, Hisense, and Xiaomi have strengthened their presence in the LCD market through cost-effective offerings, boosting their collective worldwide market share from 24.3% in 2022 to 29.2% in 2024. Over this timeframe, the joint global market share for Samsung and LG in the LCD television segment dropped from 44.7% to 40.5%.

Samsung’s comprehensive move into the OLED market is anticipated to speed up industry growth. Companies from South Korea continue to lead technologically, as their counterparts in China are not yet at par with OLED technologies. Although Chinese firms like BOE create smaller OLED displays, they haven’t progressed far enough for larger screens. At present, LG Display produces around 80% of all OLED television panels globally, solidifying South Korea’s dominance in this area.